Having universities and colleges best online flex loans consider choices to make groups personally otherwise very nearly this slip, children surely curently have a reasonable amount of fret off the fresh new following session. If or not kinds is on line or otherwise not, a projected 70% of people will pull out college loans to help funds its went on education. Based on Education loan Character, 69% off 2019 students exactly who got out student education loans inserted blog post-graduate lives with the common $31,900 gathered from inside the student loan loans. Across the country, there can be already more than $step one.5 trillion accumulated in student loan loans. Money and financial aid already are such as higher sources of stress, very here are three of the most extremely well-known education loan cons to stop.

Student loan fees fraudsters is capable of turning up near to genuine communities in listings and sometimes make comprehensive work to look legitimate, promising to greatly help repay loans. There are other tactics you to fraudsters can get implement in order to ripoff troubled youngsters.

Probably one of the most well-known frauds, with respect to the School Investor, ‘s the complex payment scam, where an effective scam artist also offers various attributes – mortgage forgiveness, finding the right interest levels or settling good loan conditions – to the standing the pupil pays a tiny commission upwards side for those functions, sometimes a portion of the amount borrowed otherwise a flat fee.

Discover never people situations where a borrower need to have to spend money in advance, so this is going to be an immediate warning sign. Federal student education loans charges a-1% default payment, and lots of personal financing charges some sort of disbursement percentage, however,, relative to Government Trading Payment recommendations, it is unlawful having businesses so you’re able to costs borrowers ahead of it assistance to a loan.

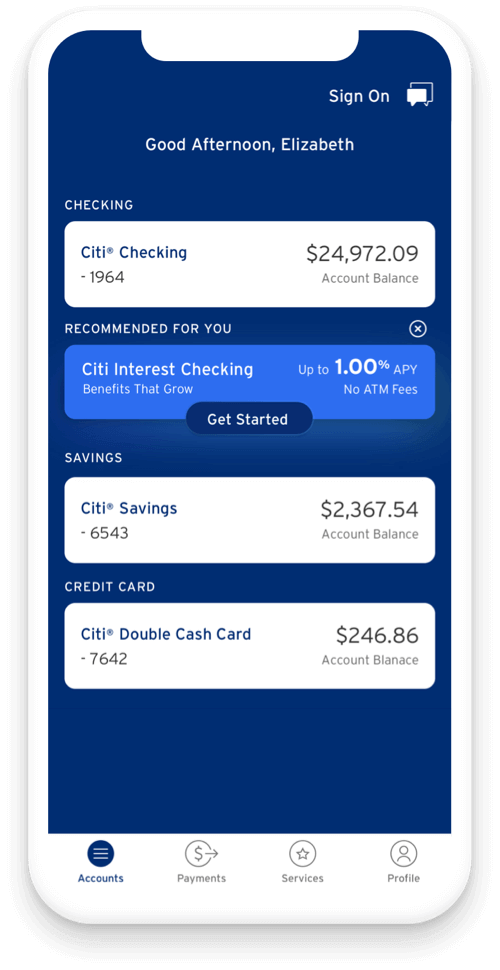

Of a lot fraudsters will endeavour so you can charge to possess features you to students mortgage servicer already really does 100% free. An informed place to begin this is exactly to set up online account which have company making sure that borrowers can be song progress and keep details from correspondence. If a message or page appears doubtful, the web based webpage can serve as a means of verifying the validity of any interaction.

After this type of online membership have been created, it is imperative to never ever hand out log in information. Scammers will state they you want usernames and you may passwords so you’re able to do funds, however, that it metropolises consumers inside an effective precarious updates regarding shedding control of its profile, without legitimate providers do ever before demand this post.

Total removal of loans

Other very common ripoff comes to fraudsters claiming to be able to entirely get rid of a beneficial borrower’s education loan financial obligation. Rather than a good federally being qualified need, including school closing, identity theft & fraud, dying or permanent handicap, education loan debt will never feel got rid of. There is also no such as for example material as fast mortgage forgiveness.

When the a third party company offers a deal you to definitely seems also good to getting real, it most likely is. Mortgage forgiveness is actually obtained simply immediately after an abundance of qualifying money are produced, and there’s no chance in order to facilitate this action getting government loans.

In identical vein, consumers might be careful of any also offers that appear since restricted go out even offers pressuring those in personal debt to act now in order to allege some sort of prize. Since the mortgage personal debt dont magically fall off, there can be essentially you should not rush in order to satisfy any deadline having perhaps not become recommended by a payment package.

Mortgage consolidation cons

Fraudsters may also provide mortgage consolidation services if you find yourself recharging an operating or administrative percentage. Although not, federal education loan integration you can certainly do from the debtor at the totally free anyway. Any company you to definitely claims to keeps an affiliation into the Company out of Degree in order to effortlessly combine financing may become a scam.

Your final red flag to save an eye aside to possess is even when a friends advertises toward social networking or into search-engines. In the event that a buddies was paying for advertisements, they fundamentally means they are seeking to make money. Given that mortgage combination is actually a no cost solution given by the new government bodies, a concerning-funds organization might possibly be a program so you can ripoff individuals for the using to have if you don’t free features. Therefore, it’s always vital that you search prior to giving personal information to the internet-based forms achieved courtesy adverts.

Regarding the unfortunate knowledge that somebody comes across a scam associated in order to student loan loans, individuals should declaration it into Government Trading Percentage while the county lawyer general’s place of work, all of and therefore depend heavily to the consumer problems so you can clear the brand new student loan field of fraudsters whenever possible.